Question 9:

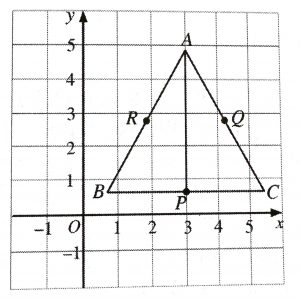

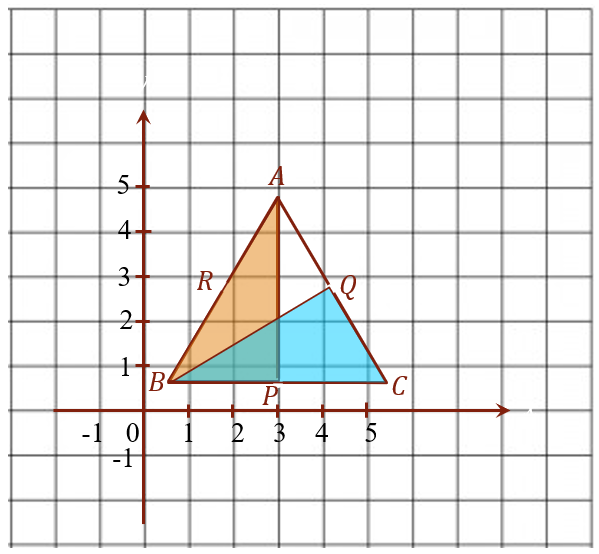

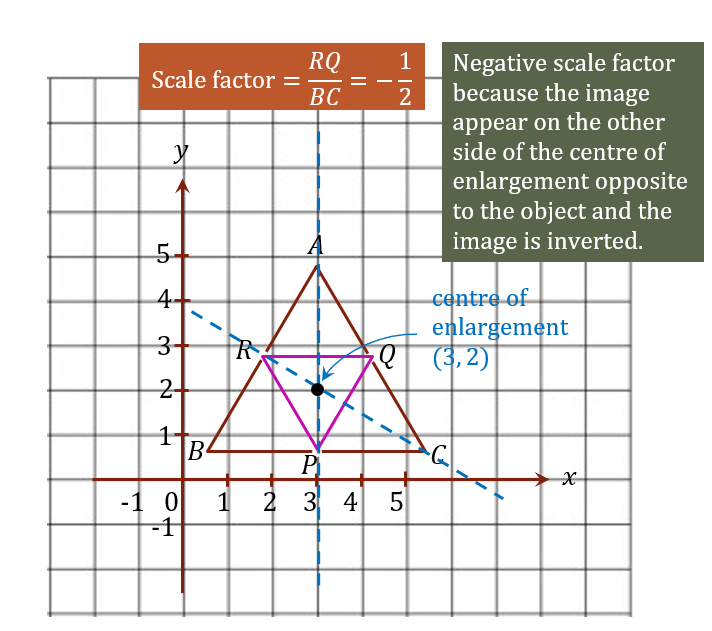

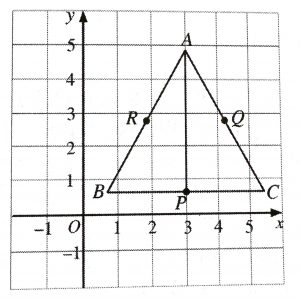

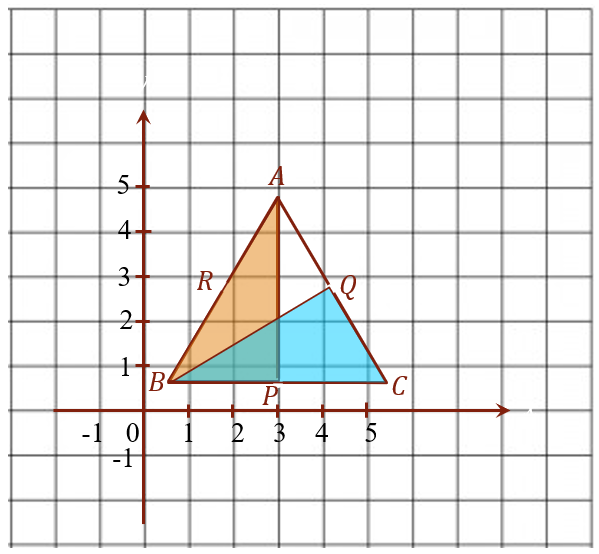

Diagram 5 shows an equilateral triangle ABC drawn on a Cartesian plane. Points P,Q and R are the midpoints of lines BC, AC and AB respectively.

(a) State whether triangles APB and BQC are congruent. Justify your answer. [1 mark]

(b) Triangle PQR is the image of triangle ABC under a single transformation. Describe fully, the transformation. [3 marks]

Solution:

(a)

Yes, triangles APB and BQC are congruent, because AB = BC, BP = QC dan AP = BQ

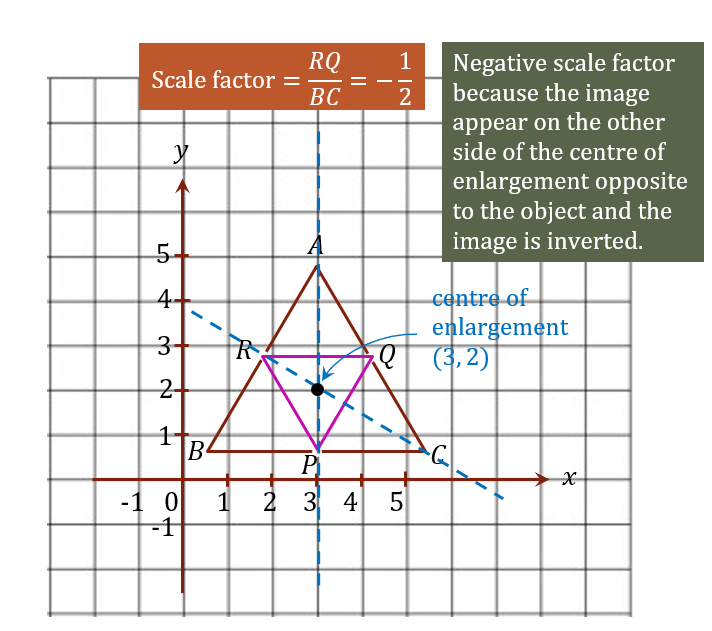

(b)

$$ \text { Enlargement at centre }(3,2) \text { with a scale factor of }-\frac{1}{2} \text {. } $$

Diagram 5 shows an equilateral triangle ABC drawn on a Cartesian plane. Points P,Q and R are the midpoints of lines BC, AC and AB respectively.

(a) State whether triangles APB and BQC are congruent. Justify your answer. [1 mark]

(b) Triangle PQR is the image of triangle ABC under a single transformation. Describe fully, the transformation. [3 marks]

Solution:

(a)

Yes, triangles APB and BQC are congruent, because AB = BC, BP = QC dan AP = BQ

(b)

$$ \text { Enlargement at centre }(3,2) \text { with a scale factor of }-\frac{1}{2} \text {. } $$

Question 10:

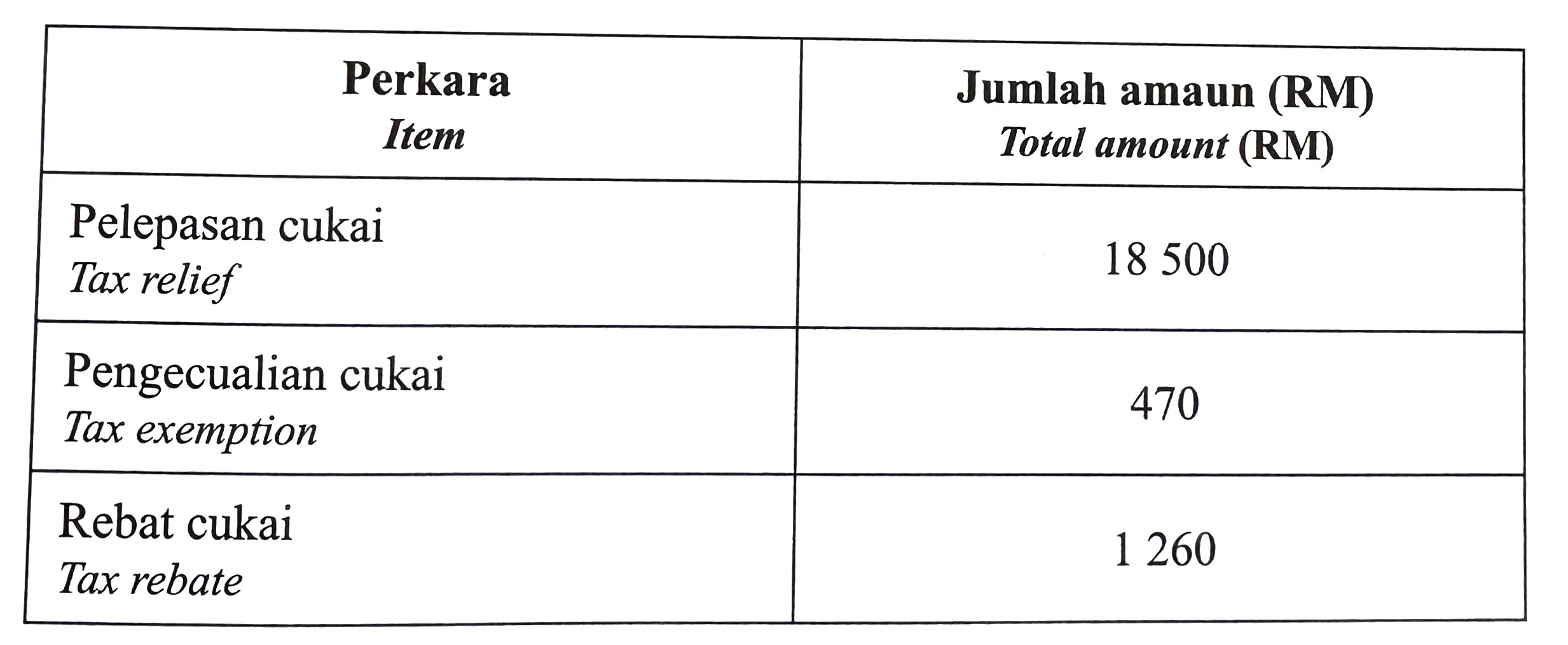

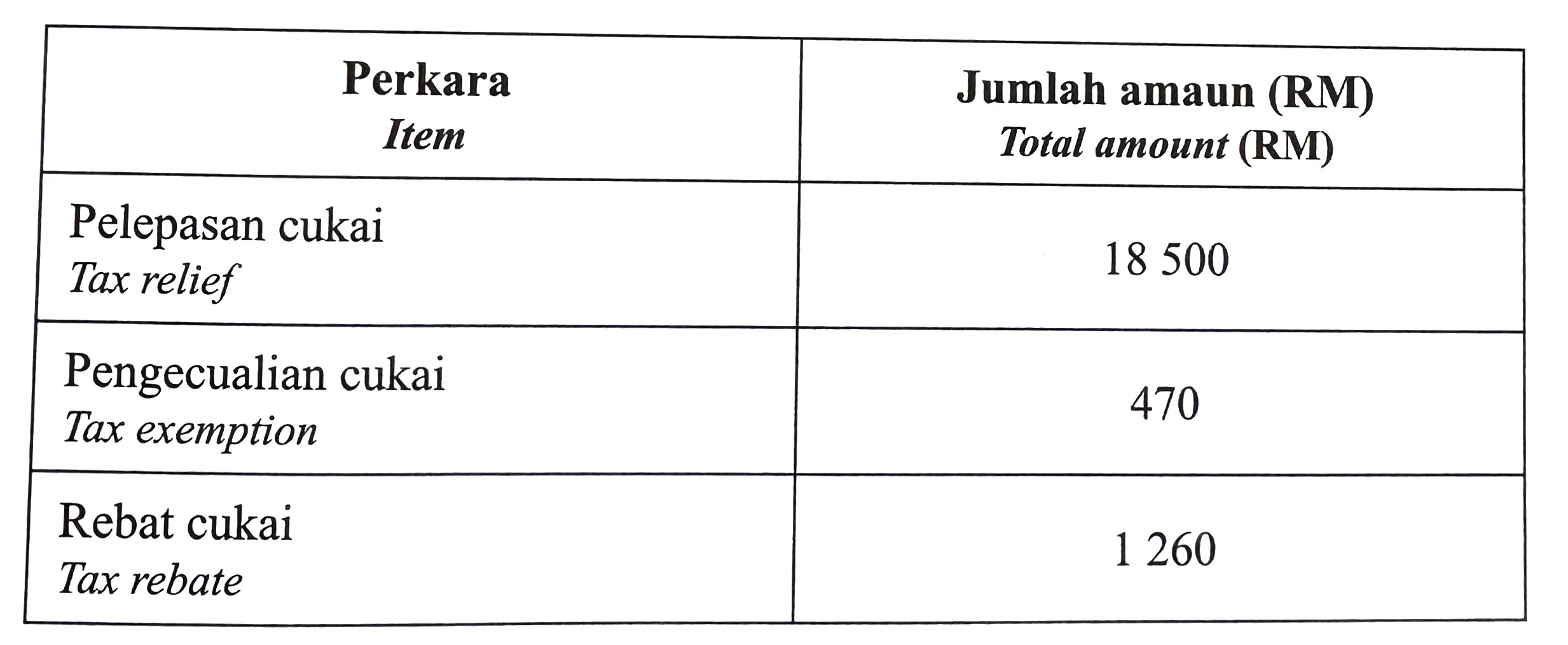

Puan Ilham’s total annual income in the year 2022 was RM69 200. Table 6.1 shows information that relates to the calculation of Puan Ilham’s income tax.

(a) Puan Ilham calculates her chargeable income by subtracting the total amount in Table 6.1 from her total annual income.

Is her calculation step correct? Explain. [1 mark]

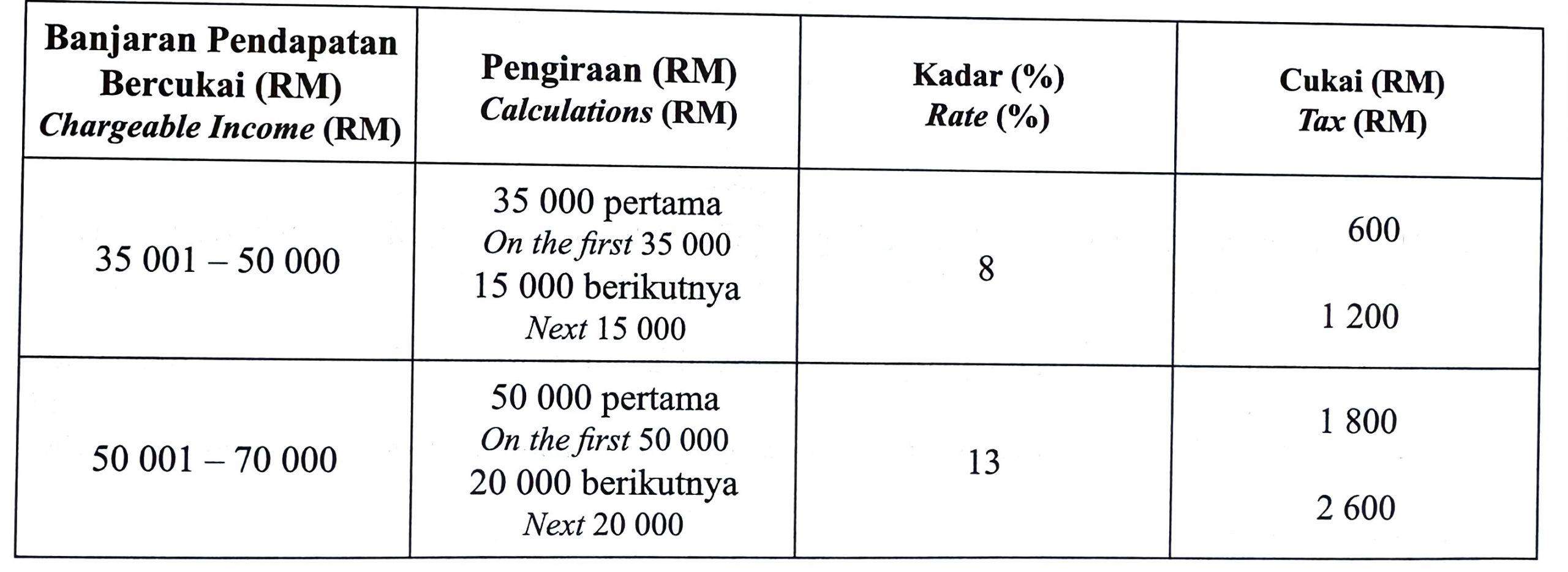

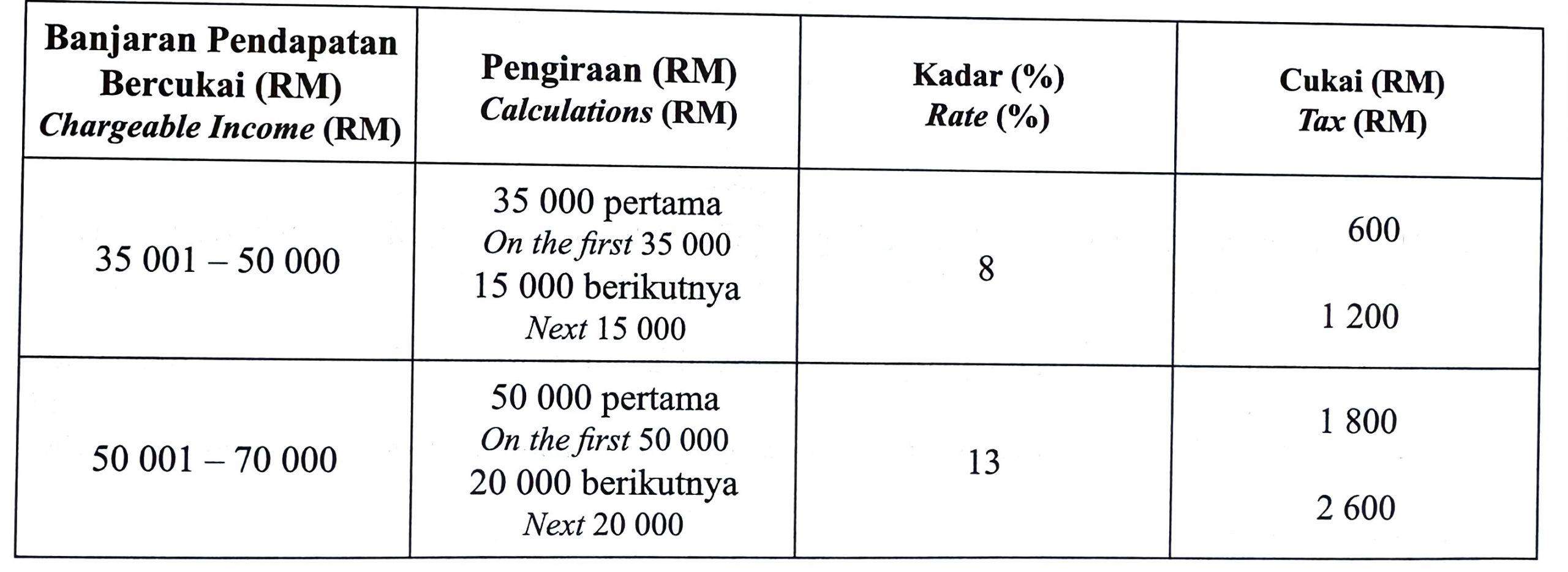

(b) Hence, by using Table 6.2 : Individual Income Tax Rates For Assessment Year of 2022, calculate the income tax that Puan Ilham needs to pay for that year. [4 marks]

Solution:

(a) Wrong, because Puan Ilham does not need to subtract tax rebate. Tax rebate is given to reduce tax to be paid.

(b)

$$ \begin{aligned} &\text { Chargeable income }\\ &\begin{aligned} & =\text { total annual income }- \text { tax relief }- \text { tax exemption } \\ & =\text { RM69 } 200-\text { RM18 } 500-\text { RM470 } \\ & =\text { RM50 } 230 \end{aligned} \end{aligned} $$

$$ \begin{aligned} &\text { Tax on the first RM50 } 000=\text { RM1 } 800\\ &\begin{aligned} \text { Tax on the next balance } & =(\text { RM50 } 230-\text { RM50 } 000) \times\left(\frac{13}{100}\right) \\ & =\text { RM29.90 } \end{aligned} \end{aligned} $$

$$ \begin{aligned} &\text { Eligible rebate = RM1 } 260\\ &\begin{aligned} \text { Income tax } & =\text { RM1 } 800+\text { RM29.90 – RM1260 } \\ & =\text { RM569.90 } \end{aligned} \end{aligned} $$

Puan Ilham’s total annual income in the year 2022 was RM69 200. Table 6.1 shows information that relates to the calculation of Puan Ilham’s income tax.

(a) Puan Ilham calculates her chargeable income by subtracting the total amount in Table 6.1 from her total annual income.

Is her calculation step correct? Explain. [1 mark]

(b) Hence, by using Table 6.2 : Individual Income Tax Rates For Assessment Year of 2022, calculate the income tax that Puan Ilham needs to pay for that year. [4 marks]

Solution:

(a) Wrong, because Puan Ilham does not need to subtract tax rebate. Tax rebate is given to reduce tax to be paid.

(b)

$$ \begin{aligned} &\text { Chargeable income }\\ &\begin{aligned} & =\text { total annual income }- \text { tax relief }- \text { tax exemption } \\ & =\text { RM69 } 200-\text { RM18 } 500-\text { RM470 } \\ & =\text { RM50 } 230 \end{aligned} \end{aligned} $$

$$ \begin{aligned} &\text { Tax on the first RM50 } 000=\text { RM1 } 800\\ &\begin{aligned} \text { Tax on the next balance } & =(\text { RM50 } 230-\text { RM50 } 000) \times\left(\frac{13}{100}\right) \\ & =\text { RM29.90 } \end{aligned} \end{aligned} $$

$$ \begin{aligned} &\text { Eligible rebate = RM1 } 260\\ &\begin{aligned} \text { Income tax } & =\text { RM1 } 800+\text { RM29.90 – RM1260 } \\ & =\text { RM569.90 } \end{aligned} \end{aligned} $$