Question 15:

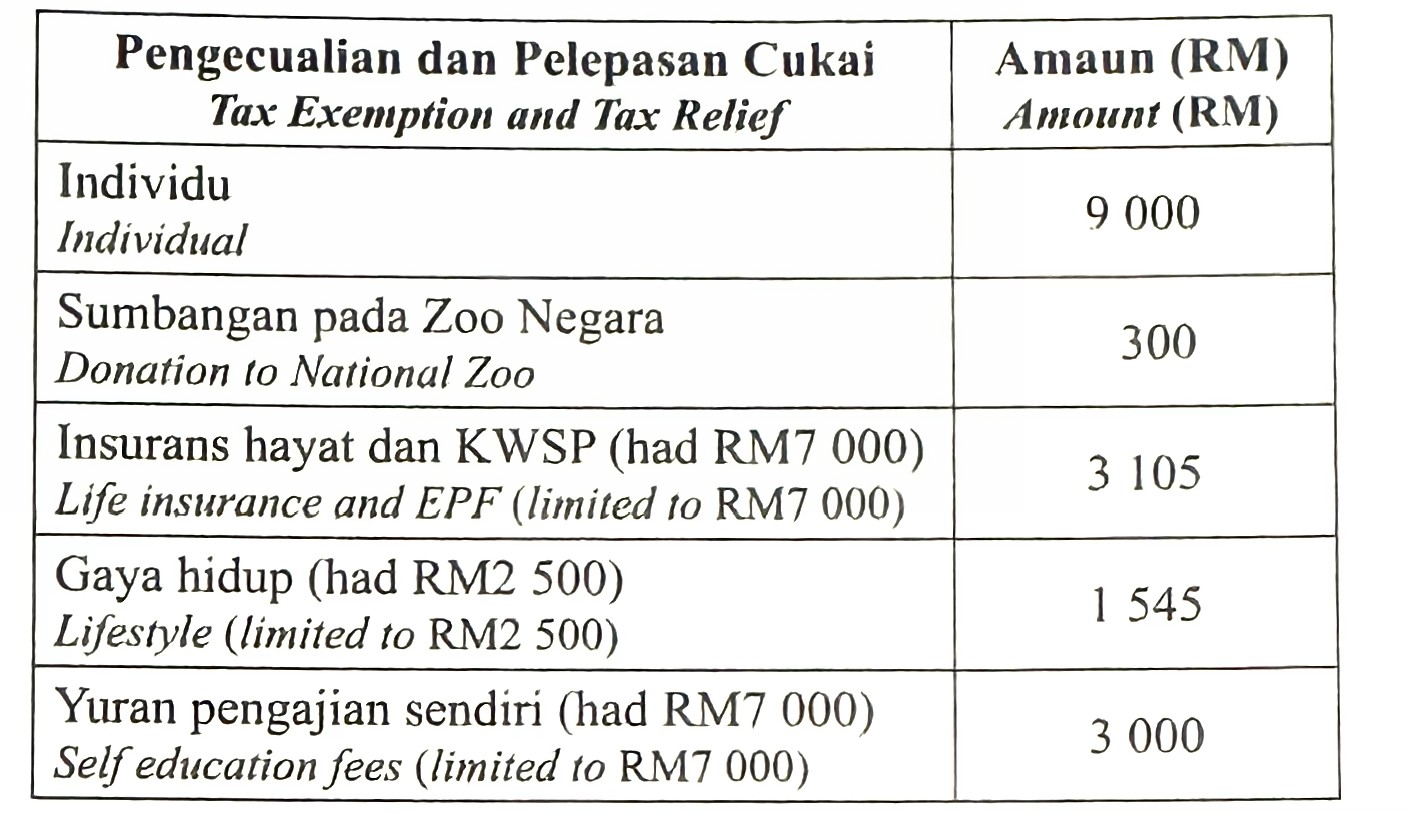

(a) Table 4.1 show/s the tax exemption and tax relief of Encik Ali in the year 2023.

Calculate the total tax relief that can be claimed by Encik Ali for that year.

[2 marks]

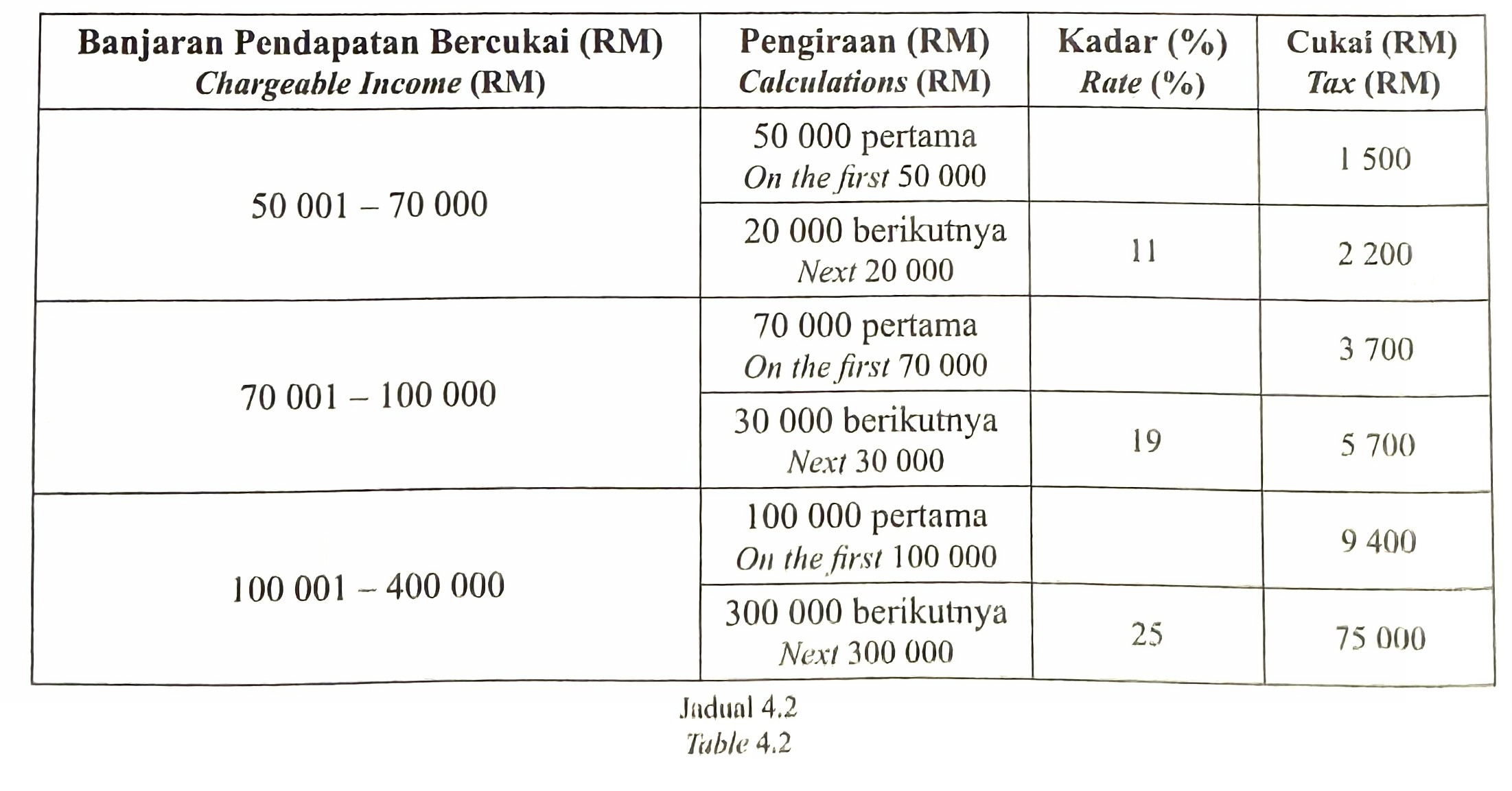

(b) In the year 2023, Encik Ali’s chargeable income was RM73 000. His wife’s chargeable income is RM5 000 less than his. Table 4.2 shows some of the Individual Income Tax Rates for the Assessment Year of 2023.

(i) Based on Table 4.2, use separate tax assessment to calculate the income tax to be paid by

(a) Encik Ali,

(b) Encik Ali’s wife.

[4 marks]

(ii) Hence, calculate the total income tax of Encik Ali and his wife by using joint tax assessment.

[2 marks]

(iii) Determine whether individual tax assessment or joint tax assessment is better for Encik Ali and his wife. Explain your answer.

[2 marks]

Answer:

(a)

$$ \begin{aligned} &\text { Total tax relief that can be claimed }\\ &\begin{aligned} & =9000+3105+1545+3000 \\ & =16650 \end{aligned} \end{aligned} $$

(b)(i)(a)

Encik Ali’s tax assessment

= 3 700 + 18/100 × (73 000 – 70 000)

= RM4 270

(b)(i)(b)

Encik Ali’s wife tax assessment

= 1 500 + 11/100 × (73 000 – 5 000 – 50 000)

= RM3 480

(b)(ii)

Total income tax of Encik Ali and his wife

= 9 400 + 25/100 × (150 000 – 100 000)

= RM21 900

(b)(iii)

Individual tax assessment.

The income tax paid is lower.

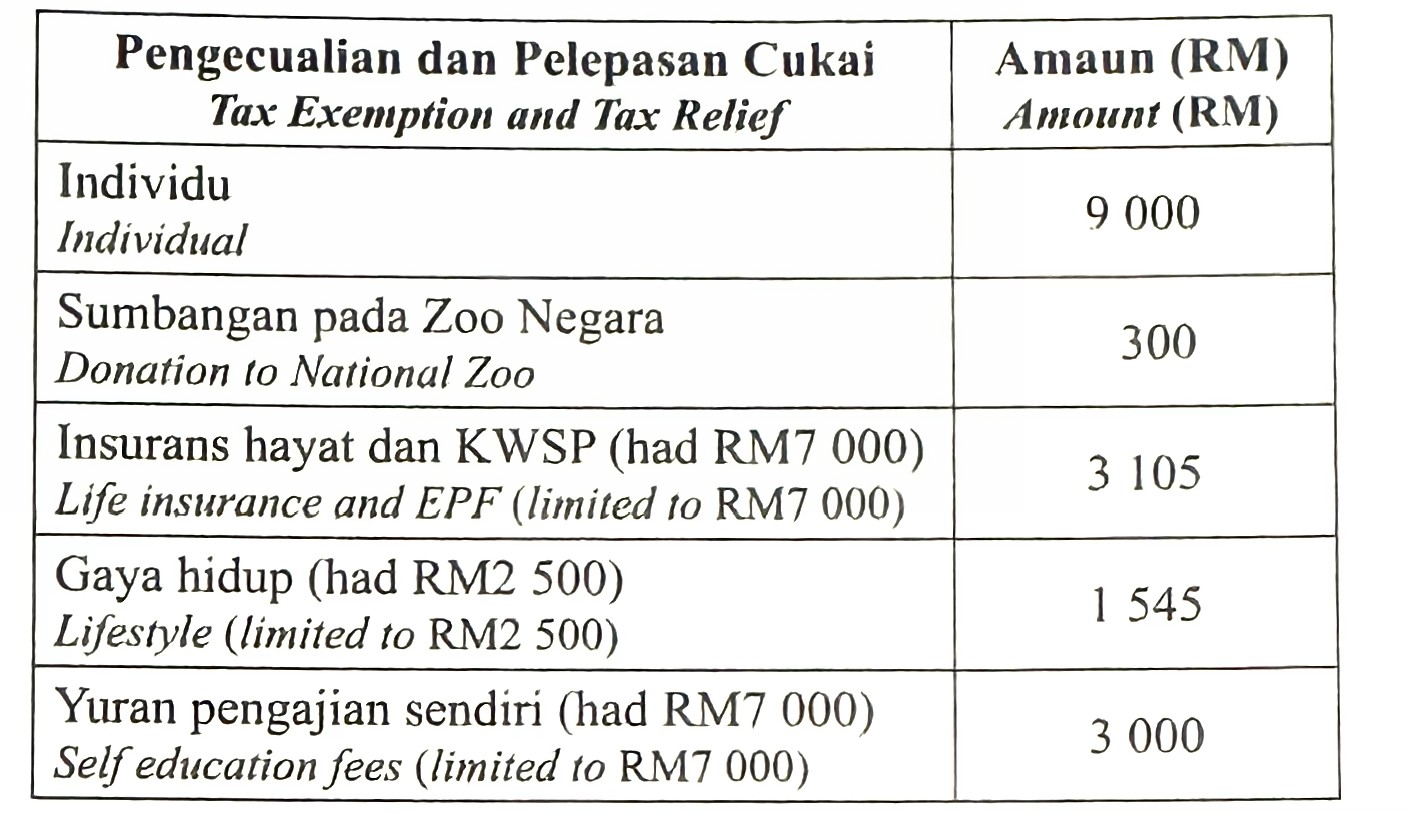

(a) Table 4.1 show/s the tax exemption and tax relief of Encik Ali in the year 2023.

Calculate the total tax relief that can be claimed by Encik Ali for that year.

[2 marks]

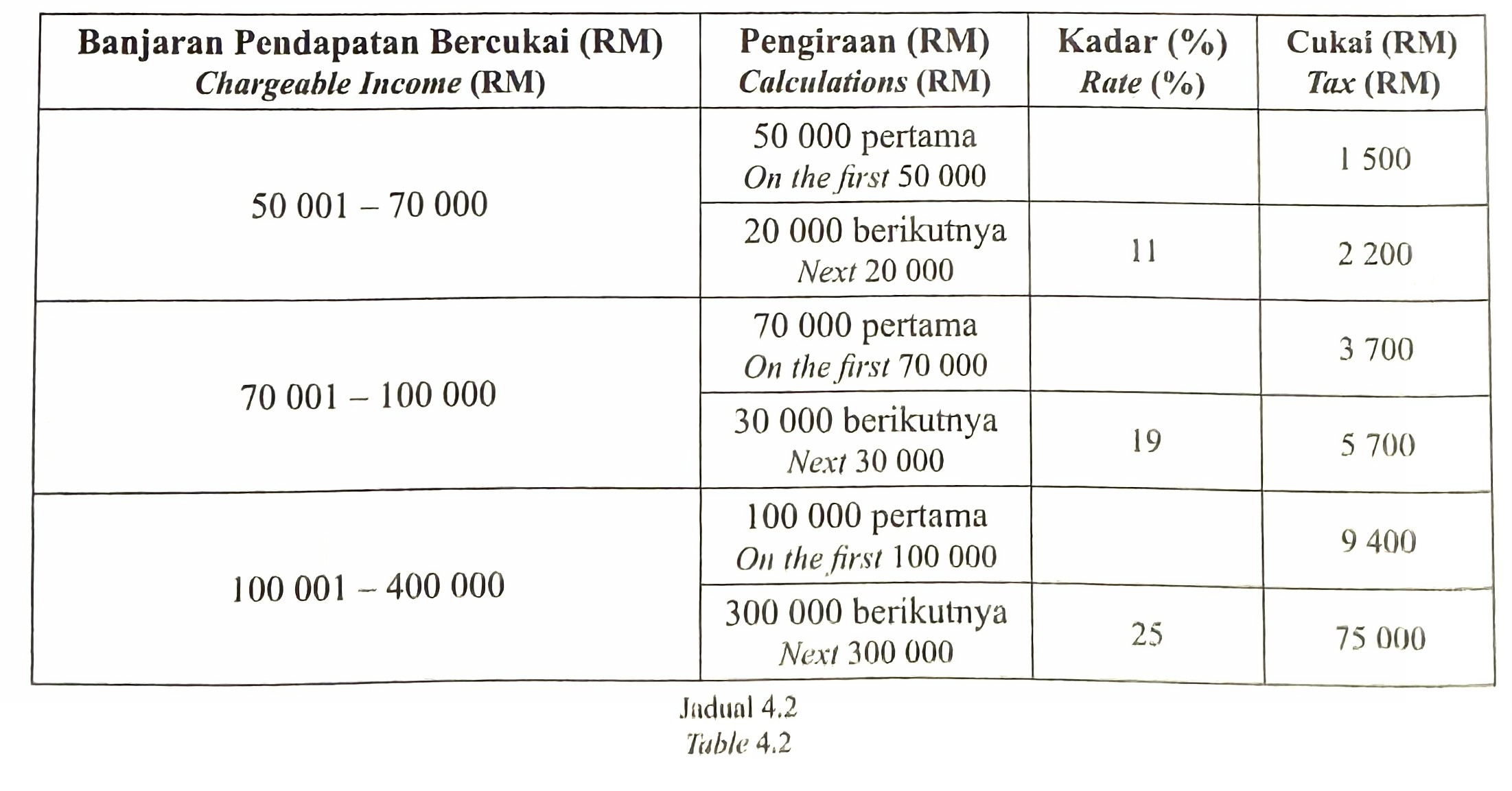

(b) In the year 2023, Encik Ali’s chargeable income was RM73 000. His wife’s chargeable income is RM5 000 less than his. Table 4.2 shows some of the Individual Income Tax Rates for the Assessment Year of 2023.

(i) Based on Table 4.2, use separate tax assessment to calculate the income tax to be paid by

(a) Encik Ali,

(b) Encik Ali’s wife.

[4 marks]

(ii) Hence, calculate the total income tax of Encik Ali and his wife by using joint tax assessment.

[2 marks]

(iii) Determine whether individual tax assessment or joint tax assessment is better for Encik Ali and his wife. Explain your answer.

[2 marks]

Answer:

(a)

$$ \begin{aligned} &\text { Total tax relief that can be claimed }\\ &\begin{aligned} & =9000+3105+1545+3000 \\ & =16650 \end{aligned} \end{aligned} $$

(b)(i)(a)

Encik Ali’s tax assessment

= 3 700 + 18/100 × (73 000 – 70 000)

= RM4 270

(b)(i)(b)

Encik Ali’s wife tax assessment

= 1 500 + 11/100 × (73 000 – 5 000 – 50 000)

= RM3 480

(b)(ii)

Total income tax of Encik Ali and his wife

= 9 400 + 25/100 × (150 000 – 100 000)

= RM21 900

(b)(iii)

Individual tax assessment.

The income tax paid is lower.